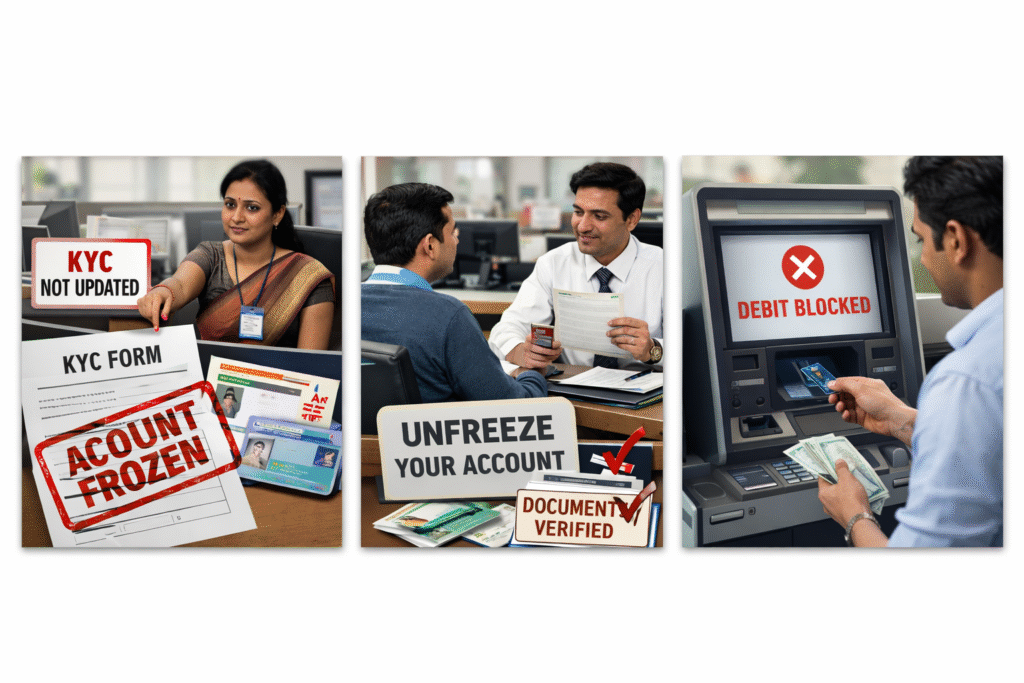

Bank account freeze reasons samajhna har customer ke liye zaruri hai, kyunki account freeze hone par debit, credit ya dono par restriction lag sakta hai, jisse daily banking transactions impact hote hain.

Achanak bank se SMS aata hai — “Your account has been frozen” — aur panic start ho jata hai.

ATM se paise nahi nikal rahe, UPI fail ho raha hai, aur samajh nahi aa raha bank account freeze kyu hua.

Agar aap bhi isi situation me hain, to ghabrane ki zarurat nahi hai.

Main ek banker ke practical experience ke saath aapko simple language me samjha raha hoon:

Bank account freeze hone ke real reasons

Account unfreeze karne ka exact process

Kitna time lagta hai aur kya-kya documents chahiye

Bank Account Freeze Ka Matlab Kya Hota Hai?

Jab bank kisi reason se aapke account par temporary restriction laga deta hai, use account freeze kehte hain.

Is condition me:

❌ ATM se withdrawal band

❌ UPI / online transfer band

✔️ Kabhi-kabhi credit (salary / interest) allowed hota hai

Freeze permanent nahi hota jab tak legal order na ho.

Bank Account Freeze Reasons in India – Top 7 Real Causes

1️⃣ KYC Update Nahi Karaya

Ye sabse common reason hai.

Aadhaar, PAN, address proof incomplete hone par bank freeze kar deta hai.

➡️ Especially old accounts & Jan-Dhan accounts

2️⃣ PAN–Aadhaar Link Nahi Hai

PAN aur Aadhaar link nahi hone par:

Account partially ya fully freeze ho sakta hai

High-value transactions pe block lag jata hai

3️⃣ Long Time Se Account Use Nahi Hua

Agar:

12–24 mahine se transaction nahi hua

Zero balance + inactivity

To bank inactive account freeze kar sakta hai.

4️⃣ Suspicious / Unusual Transaction

Suddenly:

Bahut zyada cash deposit

Unknown source se large credit

Frequent UPI failures

➡️ Bank safety ke liye account freeze karta hai.

5️⃣ Income Tax Notice / Compliance Issue

Agar:

Income tax department ka notice aaya

PAN misuse ya mismatch hua

To bank ko instruction mil sakta hai.

6️⃣ Court Order / Legal Case

Recovery case, loan default, ya legal attachment ke case me:

Account completely freeze ho sakta hai

Isme bank kuch nahi kar sakta jab tak order clear na ho.

7️⃣ Galat Document Upload / Verification Fail

Online KYC ke time:

Blurry photo

Wrong PAN

Aadhaar mismatch

➡️ Verification fail hone par freeze lag jata hai.

Account Freeze Hone Par Kya Kare? (Step-by-Step)

✅ Step 1: Bank Branch Visit Kare

Apni home branch ya nearest branch jayein.

✅ Step 2: Required Documents Le Jaayein

Generally ye chahiye:

Aadhaar Card

PAN Card

Account number

Mobile phone (SMS verification ke liye)

✅ Step 3: Reason Confirm Kare

Bank se clear puchiye:

“Mera account kis reason se freeze hua hai?”

Ye jaanna bahut zaruri hai.

✅ Step 4: KYC / Compliance Complete Kare

Form fill karwa ke:

KYC update

PAN–Aadhaar linking confirmation

⏳ Account Unfreeze Hone Me Kitna Time Lagta Hai?

Normal cases: 2–5 working days

Compliance / tax cases: 7–10 days

Kya Freeze Account Se Paise Nikal Sakte Hain?

Situation pe depend karta hai:

Mode Allowed?

ATM Withdrawal ❌ No

UPI / Net Banking ❌ No

Branch Cash Withdrawal ✔️ Sometimes (with approval)

Salary Credit ✔️ Usually Yes

Future Me Account Freeze Kaise Avoid Kare?

KYC time-to-time update rakhein

PAN–Aadhaar link confirm karein

Account inactive na chhodein

Unknown large transactions avoid karein

FAQs – Bank Account Freeze

Q1. Account freeze hone par salary aati hai?

👉 Haan, kai cases me credit allowed hota hai.

Q2. Zero balance account bhi freeze hota hai?

👉 Haan, agar KYC incomplete ho.

Q3. SMS nahi aaya par account freeze hai?

👉 Branch visit karke reason confirm karein.

Final Advice (Banker Note)

Account freeze common issue hai aur zyada tar cases me easily resolve ho jata hai.

Delay tab hota hai jab customer branch visit postpone karta hai.

Ek choti si baat dhyan rakhiye — documents complete rakhenge to problem nahi aayegi.

Kya Har Bank Me Same Account Freeze Rules Hote Hain?Haan, India me lagbhag sabhi banks — jaise SBI, HDFC, ICICI, PNB — RBI guidelines follow karte hain.However, process aur documents thode different ho sakte hain. Isliye account freeze hone par apni branch se exact requirement confirm karna hamesha better hota hai.